The cool thing with compliance projects is…

They are actually very well suited for applying and training the MECE problem solving approach. A lot you might already the principle. If or if not, I will not hesitate to show its exemplary application in one of the projects I have been engaged in recently.

MECE is an abbreviation for “Mutually Exclusive and Comprehensively Exhaustive”. Mutually exclusive means that each part of a problem can be distinguished exactly from all other parts of the problem on the same level. Comprehensively exhaustive means that all parts of the problem together comprise the full body of the problem, again this applies on the different levels of the problem.

Some easy examples:

– Men and Women are mutually exclusive… you either have to be in the group of men or in the group of women. (Some people may switch in between though)

– Together, men and women form the comprehensively exhaustive group of human beings. There are no animals, plants or aliens in the group of human beings. So with men and women humanity is a complete entity.

– A company may group their customers according to their revenue per customer per year. The group of high turnover customers may start at 5 million Euros per year. This creates to mutually exclusive groups: customers with 5 million revenue or more and customers with less than 5 million annual revenue. However in total these two groups comprise all customers thus being comprehensively exhaustive.

– It for sure works with more and deeper grouping. You may group human beings by their size, group cars by their colour or … or… or

Now back to compliance. A company is either compliant or not. In order to become compliant it has to follow specific rules. Mainly industry-specific I should say. In the banking sector there are more rules to follow and they are more complex than in the fashion retail sector. The reason for this is the degree of regulation applying for a specific industry. This is another important principle – regulation means in fact “laws” that exactly define allowed and disallowed products and processes.

The MECE principle is an excellent way to become compliant. Actually it works best in topics and problems that are definable to a high degree. Grey areas are not suited that well for MECE applications.

So let´s assume a bank needs to comply with a law that says something like: “though shalt not give investment advice to citizens of XYZ country”. This puts the bank´s business in front of the question: “How can we become compliant to this law?”

The first thing the bank has to do is to define the business problem. A very helpful way is to think in the following steps:

- There is an existing situation

- A complication to that situation arises requiring a change

- This leads to certain questionssuch as

- Why does the complication exist?

- What are alternative resolutions to the matter?

- How can a specific resolutions be implemented

- Etc.

- After analyzing the question the answer to the problem is provided

In our example the business problem can be expressed as follows:

Situation

Our bank serves customers from all over the world and provides investment advice to them (amongst other services).

Complication

Country XYZ has issued a law that forbids us to provide investment advice to their people.

Question

How can we make sure that we do not provide investment advice to citizens of XYZ country?

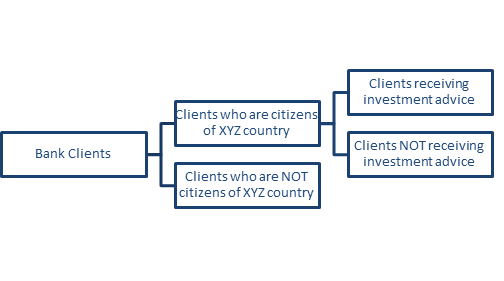

The next step is to give the problem an analysis structure. The bank needs to find out how they can ensure that no investment advice is given to XYZ citizens. So the first step would be identify the affected client group. This means the bank has to group their clients following the MECE approach:

- Clients who are citizens of XYZ country

- Clients receiving investment advice

- Clients NOT receiving investment advice

- Clients who are NOT citizens of XYZ country

The cool thing is that applying MECE leads to a very comprehensive Pyramid Structure (as you can see to the right).

So what? Well, we have completed step 1 of problem solving which is defining and structuring the problem.

We can now use this structure and start our analysis. Basically two questions arise:

- Which of the bank´s clients are citizens of XYZ country?

- Which of these receive investment advice?

In order to identify these client groups you could for instance use a list of all bank clients and filter it applying the above mentioned criteria. For instance, if a client is resident in XYZ country he/she is considered a citizen according to law. And if a client does have a depot (and not only a normal bank account) he/she for sure is receiving or has been receiving investment advice. So you would filter your client list for all clients residing in country XYZ who have at least one depot.

Eventually, having identified those clients, you can now go ahead and tell your relationship managers: “hey guys, we are not supposed to provide investment advice anymore to this group of clients, sorry”.

There is a famous book about this topic: The Pyramid Principle from Barbara Minto. It shows a variety of applications of the MECE principle and extends it with very smart approaches to solve business problems. It is actually considered THE standard when it comes to structuring and resolving problems. Go and get it – it´s definitely worth the money.